Trendy News

View All PostALL RECENT NEWS

LHDN Raids Companies Belonging To Mukhriz, Mirzan & Mokhzani

- . 30 December, 2017

- 765 Views

Datuk Seri Mukhriz Mahathir confirmed that the Inland Revenue Board (IRB) had raided his company, Opcom Holdings Bhd. Mukhriz said he will give full cooperation

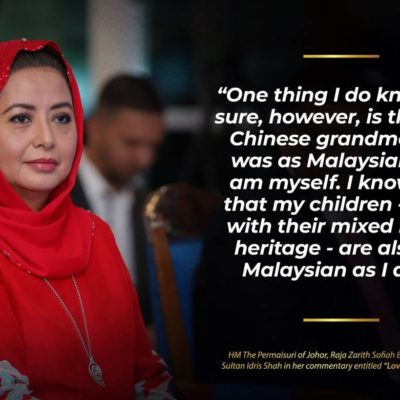

Stop Trying To Be Like Arabs, Johor Ruler Tells Malays – “It Is Not The Business Of Gov Departments To Worry About People’s Dressing”

- . 31 January, 2018

- 1,472 Views

The Sultan of Johor has called on Malays not to discard their unique culture, saying he was disturbed that some people want to stop Muslims

Tun M Labels TMJ ‘Stupid’ And A ‘Little Boy’

- . 28 January, 2020

- 473 Views

The souring relationship between Tun M and the Johor palace became all the more palpable today when Tun Dr Mahathir Mohamad labelled the state’s crown

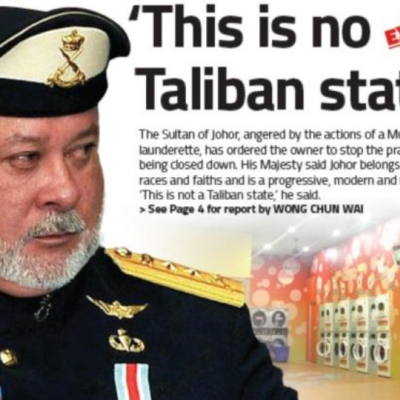

Sultan Johor : “This Is Not A Taliban State” – “I Find This Action To Be Totally Unacceptable As This Is Extremist In Nature”

- . 31 January, 2020

- 168 Views

The sign greeting customers in his shop had created a national ruckus, but the owner of a “Muslim-friendly” laundromat in Malaysia’s Johor state on Wednesday

Sultan Johor : If All Is To Be Forbidden, Then Live In A Cave – “Will The Gov Then Have To Produce Muslim-Friendly Money?”

- . 31 January, 2020

- 214 Views

Johor ruler Sultan Ibrahim Sultan Iskandar has spoken out against various forbidden practices on grounds of religion to the point of impracticality, pointing out that

PKR Lodges Report At MACC On Tun Daim’s Alleged Massive Wealth – Has Billions Of Ringgit In Banks In Africa & Eastern Europe

- . 1 January, 2021

- 725 Views

The Parti Keadilan Rakyat (PKR) lodged a report at Malaysian Anti Corruption Commission (MACC) against former finance minister Tun Daim Zainuddin for his alleged exorbitant

Sultan Johor : Chinese Are Not ‘Pendatang’ – Pays Tribute To Chinese Community Over Their Contribution

- . 31 March, 2021

- 369 Views

Sultan Ibrahim pays tribute to Chinese community over their contribution to Johor’s development. The Sultan of Johor, Sultan Ibrahim Sultan Iskandar said Johor appreciates the